Finance Qualification: Your Path to Home Ownership in Yanchep

Are you dreaming of owning a home in the beautiful coastal suburb of Yanchep? At House and Land Packages Yanchep, we're here to turn that dream into reality. Our expert team guides you through every step of the finance qualification process, ensuring a smooth journey to homeownership in this thriving part of West Australia.

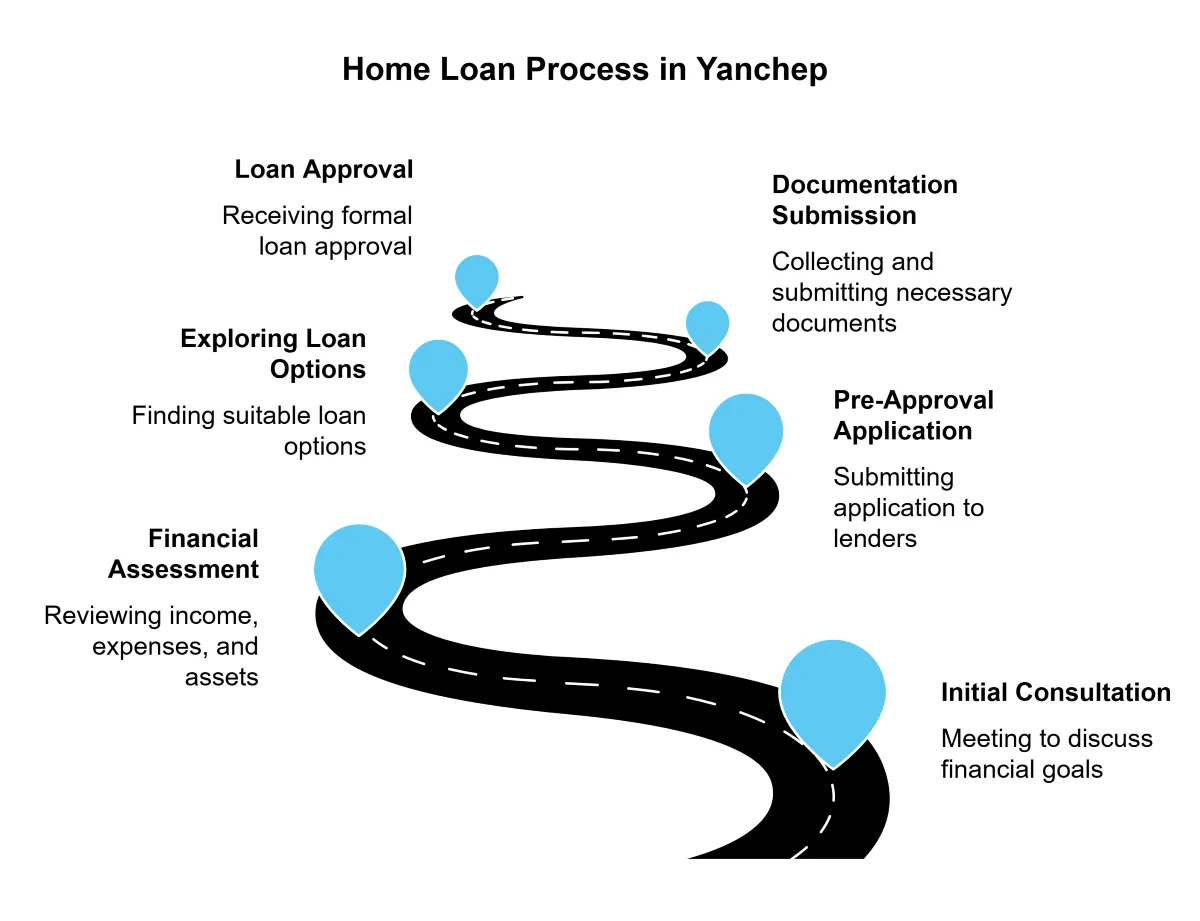

Your 8-Step Guide to Securing Your Home Loan

Step 1: Initial Consultation - Let's Get to Know You

Our journey begins with a personalized consultation. We'll sit down with you, perhaps over a coffee at one of Yanchep's charming cafes, to discuss your:

○ Financial situation

○ Home ownership goals

○ Any concerns or questions you might have

We believe in building relationships, not just processing applications. Our team takes the time to understand your unique needs, setting the foundation for a tailored home loan solution.

Step 2: Comprehensive Financial Assessment - Painting Your Financial Picture

Next, we dive deep into your financial health. This thorough assessment includes:

○ Income review (including any rental income from investment properties in booming areas like Yanchep)

○ Expense analysis

○ Asset evaluation (perhaps you already own property in nearby suburbs like Butler or Alkimos?)

○ Liability check

○ Credit history review

Our goal? To give you a crystal-clear understanding of your financial position and borrowing capacity in the context of Yanchep's property market.

Step 3: Pre-Approval Application - Your First Step to Yanchep Home Ownership

Armed with your financial profile, we help you prepare a rock-solid pre-approval application. We submit this to our network of lenders who understand the nuances of the West Australian market, including Yanchep's unique property landscape. This pre-approval is your ticket to house hunting with confidence in Yanchep's diverse neighbourhoods.

Step 4: Exploring Loan Options - Finding Your Perfect Fit

With pre-approval in hand, we explore a range of loan options tailored to Yanchep's property market. Our team provides expert recommendations, considering:

○ Competitive interest rates

○ Flexible loan terms

○ Repayment options that align with your lifestyle

We leverage our relationships with multiple lenders to secure the best possible deal for your Yanchep dream home.

Step 5: Documentation and Submission - Dotting the I's and Crossing the T's

Chosen your ideal loan? Great! We'll guide you through the paperwork maze, helping you gather and submit all necessary documents. This typically includes:

○ Proof of income (including any income from local Yanchep businesses or remote work arrangements)

○ Bank statements

○ Identification

○ Details of the Yanchep property you're interested in

Our meticulous approach ensures your application is complete and accurate, minimizing delays in your journey to Yanchep home ownership.

Step 6: Loan Approval and Conditions - Clearing the Path

After submission, the lender will review your application and issue a formal approval, often with conditions. We're by your side to help you meet these requirements, which may include:

○ Property valuation (crucial in Yanchep's dynamic market)

○ Insurance requirements

○ Any additional documentation specific to Yanchep properties

Our team's local expertise ensures you navigate these conditions with ease.

Step 7: Final Approval and Settlement - Making It Official

With all conditions met, it's time for the final loan approval. We coordinate with all parties involved:

○ Your chosen lender

○ Your solicitor

○ The seller or builder of your Yanchep property

We ensure a smooth settlement process, managing the transfer of funds and officially making you a Yanchep homeowner!

Step 8: Ongoing Support - Your Yanchep Property Partner

Our relationship doesn't end at settlement. As you settle into your new Yanchep home, we continue to offer support:

○Advice on managing your mortgage

○ Information on refinancing options as Yanchep's market evolves

○ Guidance on leveraging your property for future investments in the area

We're committed to being your long-term partner in Yanchep property success.

Why Choose Us ?

○ Local Expertise: We know Yanchep inside out, from its beautiful beaches to its growing communities.

○ Personalised Service: Every client is unique, and our approach reflects that.

○ Lender Relationships: Our connections in the industry mean better options for you!

○ Ongoing Support: We're with you for the long haul, from pre-approval to long after you've moved in

○ Superior Builder Pricing with better specification: We guarantee best builder prices - Guaranteed.

Ready to start your journey to owning a piece of Yanchep? Contact House and Land Packages Yanchep today, and let's make your coastal living dreams a reality!

Phone Number: 0483 919 628 (7 Days)

Assistance Hours

Mon – Sat 8:00am – 6:00pm

Sunday – BY Appointment

Meet us at one of our partner land sales offices in Yanchep and surrounding estates. Get in Touch

Serving - Yanchep, Butler, Alkimos, Jindalee, Two Rocks